What is a Memorandum of Sale?

A Memorandum of Sale is a written confirmation of the essential details of a property transaction.

A Memorandum of Sale is a written confirmation of the essential details of a property transaction.

It’s a simple document that’s drawn up by the estate agent after a property goes from being Under Offer to Sold STC. Auctioneers and home buying companies also often have tailor-made versions.

It is then forwarded to the solicitors representing the buyer and the seller. Email is the most common way of doing this. Although sometimes it’s posted.

Most Memorandums of Sale contain the following (in order of priority):

- Complete address of the property being sold;

- The agreed price of the property;

- HM Land Registry number;

- The name, phone number(s), email and current address of both the seller and the buyer;

- Full contact details of the solicitors representing the buyer and seller;

- Whether the property is freehold or leasehold. If it’s the latter, the Memo should also state how many years remain on the lease;

- Whether this is a quick cash house sale;

- If it’s an auction sale, information should be provided as to the date of exchange (i.e. when the hammer fell);

- How much of a deposit will be paid;

- Whether the deposit has been verified/confirmed;

- Where possible, the mortgage lender and whether there is a decision in principle in place (if so, for how much);

- The name/details of the mortgage brokers/advisors involved in the sale;

- Confirmation of ownership (via HM Land Registry). Note, the estate agent should have done this already before listing the property;

- Whether the property is being bought in a company name;

- Expected exchange and completion date;

- Special conditions of sale such as a delayed completion, cash advance or an option agreement (which can take several forms);

- Whether the vendor is buying another property and the details of the onward purchase if so;

- Any legal issues that may need investigation (such as planning restrictions, rights of way or other constraints);

- What fixtures and fittings will be included in the sale;

- Any extra notes/observations relevant to the sale.

Essentially, the more information the better.

The Memorandum of Sale should be drafted as quickly as possible in order to get the sale going.

Example of a Memorandum of Sale

Below is an example of the Memorandum of Sale we use here at Property Solvers (for both our fast house sale, auctions and 28-day estate agency services):

Can You See a Copy of the Memorandum of Sale?

In most cases, no. This is because the document contains confidential information about the seller and the buyer that’s data protected.

Please don’t worry about this. Your solicitor will reveal any important issues (and help you deal with them).

This is why we recommend working with a firm that will keep you fully informed.

Why is a Memorandum of Sale Necessary?

Having a Memorandum of Sale enables all the key information to be in one place.

Having a Memorandum of Sale enables all the key information to be in one place.

A huge amount of unnecessary time is saved in the ‘to-ing and fro-ing’ that comes with selling a house.

Once the sale has been confirmed, the agent should get the document circulated as quickly as possible. This means the sale can proceed quickly and efficiently. We also recommend producing a Memo (using the template above) even if you’re selling privately.

It’s not a complete confirmation, nor is it legally binding.

Whilst the buyer can still withdraw from the sale, as long as things are kept honest and transparent from the start, this shouldn’t happen.

Note that you do not need to sign the Memo of Sale.

Selling Your House Quickly – Memorandum of Sale

When you sell your house to a quick buying company, the process is slightly different.

The sales process is much faster and you should be given a firm date for exchange / completion.

For example, here at Property Solvers, we have previously exchanged contracts in 24 hours (in repossession cases, for example).

There may be specific stipulations in the document such as the provision of a cash advance.

These scenarios require our solicitors to have key information up front. We’ll also take out insurances to make sure the sale is guaranteed.

The added bonus is that our clients will not need to seek out conveyancing quotes nor worry about estate agency costs – as we cover all associated fees.

Auction House Sale – Memorandum of Sale

The Memorandum of Sale at an auction also differs.

At an auction sale, once the hammer (or gavel) falls, the buyer effectively exchanges contracts. He/she is legally committed sale.

He/she will then be required to complete the Memorandum of Sale straight away plus pay the deposit (usually between 10 and 25%) and the auction house fees.

Note that all the ID checks are done on the day as well.

The Memorandum of Sale will then be forwarded to both solicitors alongside the exchange contract other relevant documentation.

Note that online auction houses will have a similar process. These firms are often more efficient and faster than traditional auction houses.

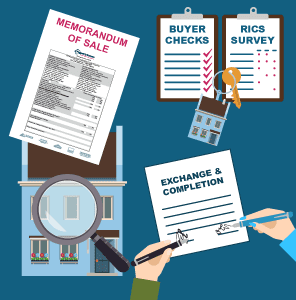

What Happens After You Send the Memorandum of Sale

The Memorandum of Sale is the first stage of the house sale process.

The Memorandum of Sale is the first stage of the house sale process.

It means that the estate agent, if you are using one, can change the property listing to ‘Under Offer’ or ‘Sold – Subject to Contract (STC)’

Once both solicitors receive it, the real work can then start.

But… It certainly does not mean that everything is done.

Buyer Checks

Please ensure that your estate agent has checked the buyer’s financial position before moving forward with things.

Typically, this means proof of a mortgage offer (within the last 2 months). This is sometimes known as a ‘Decision in Principle (DIP)’ or ‘Agreement in Principle (AIP)’.

We sometimes also ask for proof of deposit to make sure the buyer can truly afford the purchase.

Conveyancing

Both solicitors begin communicating with each other to start the process.

They will also undertake the necessary ID checks (if they haven’t already) and may ask for some funds on the account to start their work.

The following forms will need to be filled out:

- TA6: Property Information Form;

- TA10: Fixtures & Contents Form;

- TA7: Leasehold Information Form (if you’re selling a flat usually).

Click here to see specimens via the Law Society website.

The solicitor will also require:

- 2 forms of certified identification;

- Any warranties, guarantees, planning permission, building control certificates etc.;

- The Title Plan / Register. Note that your solicitor can organise these documents if you do not have copies;

- Other information related to the property that can help move things forward.

The necessary arrangements with the mortgage company can also now start.

This is to make sure the mortgage funds can be drawn down at the point of contract exchange.

Searches

The buyer’s solicitor will also undertake Local Authority, Environmental, Water/Drainage, Chancel repair, Coal/Tin mining, Brine/Common Registration and Clay searches.

Survey

Most buyers will book in some kind of survey.

The main ones – which always should be conducted by a professional from the Royal Institute of Chartered Surveyor (RICS) – are:

RICS General Condition Report

This is usually a minimum requirement of most mortgage companies.

The survey involves a check on the overall state of the property without going into too much detail.

It will involve a RICS-qualified surveyor spending no more than an hour (depending on the size).

The surveyor will flag up any notable issues. However, it’s not the best form of survey to use if the property has serious conditions.

RICS Homebuyers Survey

This a more in-depth survey that provides key information about any potential issues with the property.

For example, the report will highlight damp, subsidence or other structural issues.

Qualified surveyors will report these problems without moving furniture or causing any real disruption to the seller.

The homebuyers survey will also have a valuation. This will typically use HM Land Registry sourced data (highlighted in this post) and factor in any issues.

It sometimes means that the buyer may approach the seller to renegotiate the price downwards.

Here, it will be at the seller’s discretion to move forward or not.

Once you agree to the price correction, there’s usually no need to revise the Memorandum of Sale.

Simply informing the solicitors should be enough.

RICS Structural / Building Survey

The Level 3 Building’s Survey is the most rigorous form of survey available which buyers sometimes go for to get peace of mind.

Despite the higher cost, buyers often get one if the property is old, unrefurbished for years or it’s unusual in some way.

The surveyor will take an almost forensic approach and produce an exhaustive report running through the works required.

The buyers will also see information about the costs to bring the property back to a good standard.

In other circumstances, a Red Book Valuation may be more appropriate (or can be undertaken together with one of the above).

Property Enquiries

The solicitors will communicate between themselves and raise “enquiries” (typically via email) that could potentially affect the sale. Examples include checks for encumbrances, restrictive covenants, positive / negative easements, overage clauses amongst others.

Other times, if the property is leasehold, checks will need to be made with the freeholder / management company.

Once they have all this, they’ll summarise their findings. Your solicitor may refer to this as the Report on Title.

Exchange of Contracts & Completion of Sale

Assuming the survey comes back fine and there are no further enquiries, the solicitors will agree on a date for exchange and completion.

You will be sent a Transfer (TR1) form to sign and send back. Note you’ll need to independently witness this form.

These can often happen on the same day, over a couple of days/weeks or even months. In most cases, most buyers and sellers prefer to exchange and complete quickly.

Property Sale Chain Complications

A property sale chain is when a home buyer and seller end up tied together as the purchase is dependent on another transaction.

The ideal buyer usually isn’t selling his/her own property to buy yours.

This means that the risks of the other sale falling through will not pass on to you.

There are ways to get through a situation where a dependent sale does fall through.

In our experience, communication is key.

Experienced solicitors will know how to handle such cases and eliminate any potential problems in good time.

These include:

- Explore what the problem is. If it’s money-related, maybe some funding can found from somewhere (through friends or family, for example) to ‘plug the gap’;

- If there was a strong demand for the property, perhaps the estate agent can replace the buyer. A lot of the paperwork is done already and a good solicitor will be able to take over the conveyancing reasonably quickly;

- Although likely to fall on deaf ears, there’s no harm in suggesting a price drop to the buyer;

- The seller of the property that’s chain has fallen through, may want to approach a company like Property Solvers. We can complete in as little as 7 days there will be no estate agency or legal fees to pay;

- If you don’t need to move fast, frustrating as it may be, being patient may be the best way to handle things.

Remember to watch out for ‘gazundering‘. This is where homebuyers try to drop the price at the last minute and sadly happens in our own industry.

Sadly, it happens a lot in our industry.

In such scenarios, if you can, it’s always best to step away from the transaction.