Since the onset of the credit crisis back in 2007, many would remember how the country plunged into a period of turbulence. Banks were bailed out, unemployment rose and many predicted a long period of recession.

As part of the recovery plan, the Bank of England´s had to make major decisions. It started by injecting a huge amount of money into the banking system (quantitative easing). Alongside this, the Bank’s Governor Mervyn King dropped interest rates to 0.5% in 2009. This was further dropped to 0.25% in the aftermath of the Brexit decision.

Looking back, many now ask: did the gamble pay off? A lot of homeowners were largely able to “ride the storm” of falling house prices and keep up with their mortgage payments. This was in sharp contrast to the previous recession during the early 1990s where interest rates reached as high as 15% and repossession levels soared.

These low interest rates have also meant that property prices recovered in most parts of the country. Indeed, to many people’s surprise, in Greater London and across much of the South property values are much higher than a decade ago.

However, at the same time, many experts question how stable the British housing market actually is. With so many homeowners now used to paying low interest rates on their mortgages, all it would take are a few increases for household incomes to be seriously affected. Indeed, responding to ongoing inflationary pressures, the Bank of England raised interest rates for the first time in over a decade back up to 0.5% in November 2017. Whether this will continue remains to be seen.

This, of course, does not mean that interest rates will rise to the levels of a few decades ago. However, homeowners may find that their budgets become more squeezed.

So Where Now?

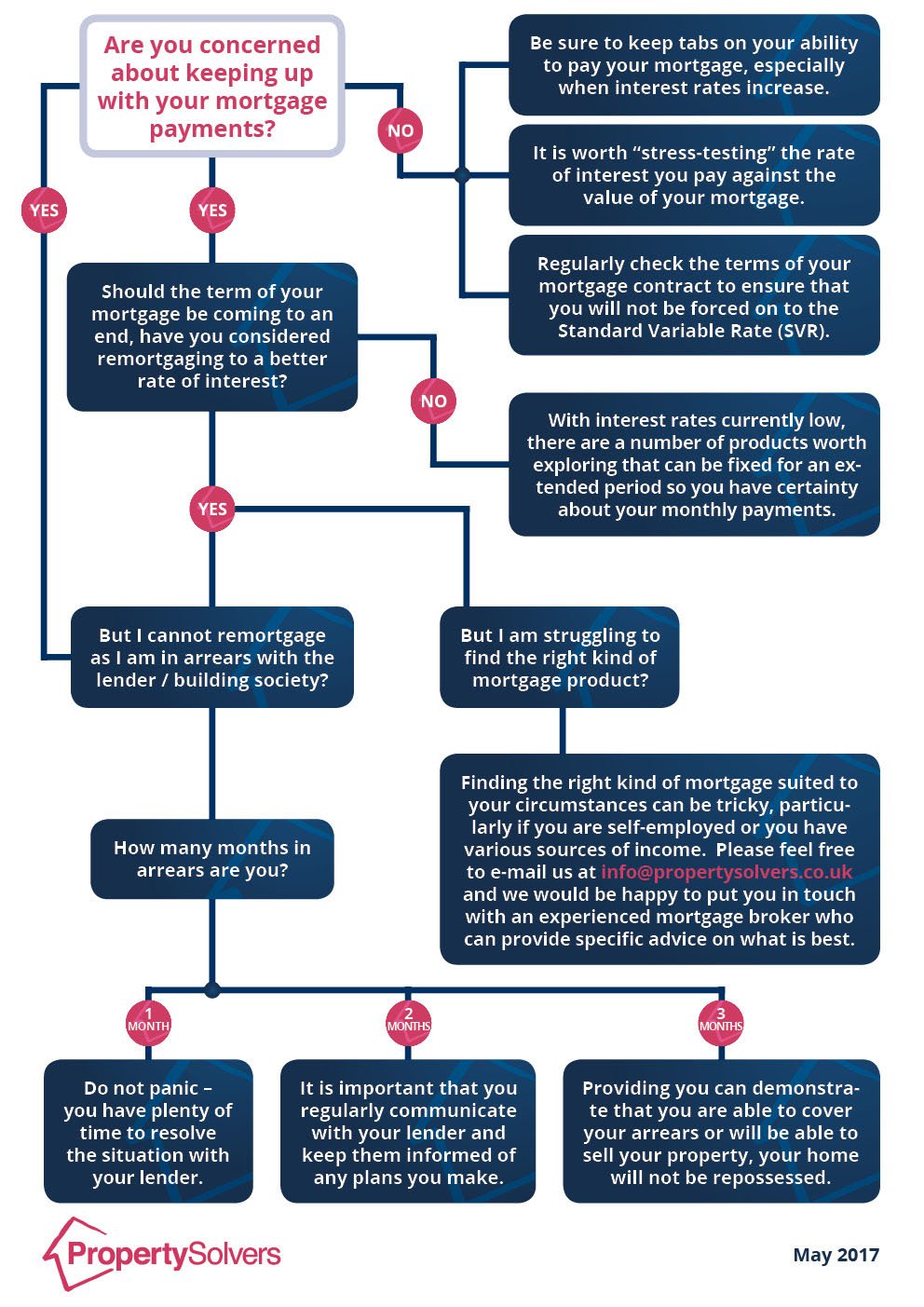

Moving forward, if you are a homeowner with a mortgage it is never a bad time to look at your household finances. The flowchart below aims to help you understand your current position regarding your mortgage payments and act accordingly. Please click here to see a printable version of this file.

Near the top of the flowchart, we refer to the idea of “stress testing”. It is always a good idea to observe what your mortgage payments would be at various interest rates. You can then make sure you are prepared to handle such a situation. This excellent calculator from the BBC enables you to adjust the amount of borrowings, level of interest and repayment period to see what your monthly repayment would be.

Should you like to know more about our services as quick property buyers, please feel free to fill your details on our contact form below. Alternatively, leave us a message 24/7 on 0800 044 3696 or e-mail us at info@propertysolvers.co.uk.

—

* In our previous blog post, please scroll down to see a graph of house prices as measured by the Land Registry, LSL / Acadata, Nationwide, Rightmove and the Halifax.