Whether you are planning to make a cash offer or you have applied for a mortgage to purchase property, you may be required to provide “proof of funds”.

But what is “proof of funds” when buying a property? What documentation will solicitors, estate agents and auctioneers accept for this purpose?

In this article, the real estate buying specialists at Property Solvers delve into what you’ll need to do…

What is “Proof of Funds” When Buying a House?

When buying a property, proof of funds is a vital part of getting started.

An estate agent, solicitor or auctioneer will almost always request real evidence of the buyer’s financial capacity to pay the agreed price for the property before a sale can get underway.

Sellers dealing with a We Buy Any House company like Property Solvers also like to see proof of cash funds to have peace of mind that we will fulfil our promises.

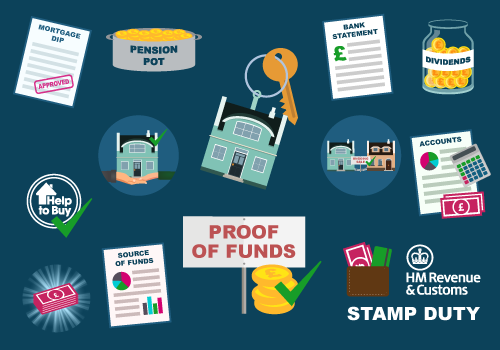

Here are some of the most common types of proof of funds:

- Bank statements (usually dating back to the last month or earlier if possible). This will either be for the full cash amount or the deposit, usually at a minimum of 15%

- A mortgage agreement / decision in principle which – added to the deposit – will equal 100% of the agreed sale price. Note these are abbreviated to AIP and DIP

- Sufficient funds required to complete the sale for costs such as Stamp Duty Land Tax (SDLT), legal and estate agency fees

- Evidence of Help to Buy finance grant

- Your accounts (if you are self-employed or run your own business)

- Evidence that you have recently been given sufficient funds as a gift or through probate

- Evidence of an ongoing property sale that covers the required amount (and when the transaction will definitively complete)

- Proof of finance source (particularly if you’re an overseas buyer)

- Proof of dividends received, or the sale of shares

- Official information regarding a pension pay-out

- Documentation evidencing a cash prize or lottery win

The various kinds of evidence listed above may each be acceptable on their own. Alternatively, you may be asked to provide multiple documents.

When Do You Need to Show Proof of Funds?

We would suggest having proof of funds prepared before you make any type of offer on a property.

An estate agent won’t be able to accept an offer from you without a mortgage in principle or evidence that you have immediate access to the full amount of cash required upfront (see below).

Should your offer get accepted, your solicitor will need to see that you have the financial means to purchase the property

You’ll often usually require proof of funds for a property purchase at auction, too. Auctioneers also commonly request evidence upon registration, in order to crack down on fraud and money laundering. This means you’ll need the relevant documentation before you can bid on auction property.

Benefits and Drawbacks of Having 100% Cash as Proof of Funds

Having all the cash available upfront to buy a property can be a great help.

Provided that the offer is fair, sellers tend to prefer this type of transaction. The process moves a lot quicker (with a lot less hassle) relative to those that involve mortgage finance. This means that, as a buyer, you can position yourself in a stronger negotiating position.

However, with property being so expensive, it’s often unfeasible for most buyers to proceed with the sale in this way. Locking all your money into a property may also not be the best decision should you need it for other purposes down the line.

The difficulty here is that property is an illiquid asset class – meaning that you cannot access the cash quickly. It could take several months to resell and even refinance. Note that f you went for the latter option, you would still need to leave some money into the property.

Property Solvers’ Proof of Funds

Property Solvers have operated in the cash buying sector for almost 2 decades and have a strong financial capacity to buy homes for cash.

We can provide the proof of funds as part of our no-obligation offer. If you are happy to accept we can close the sale and exchange contracts within seven days.

Because we’ll buy the property from you directly, there will be no delays as you wait for buyers to make offers. You will also be able to avoid paying costly solicitor’s fees and estate agency fees.

For further information about the fast home sales services provided by Property Solvers, simply get in touch us 7 days a week. We’ll be very happy to assist you…